Ethical debt is an important topic for enterprise at the moment. We explore how enterprise architects can take the lead in mitigating ESG risk.

Ethical debt is a new concept that's starting to take root in discussions around enterprise architecture management. Just as technical debt is the consequence of not investing in your technology, ethical debt is what you'll need to face if you don't deal with environmental, social, and governance (ESG) issues.

From catastrophic coverage in the press, to run-ins with regulators, ignoring ESG can have devastating consequences for an organization. To avoid this, you need to deal with the ethical debt you've built up before it becomes an issue.

This may all seem above the pay grade of enterprise architects, but boards are increasingly turning to the experts with maps of their organization's IT landscape and business capabilities for answers. Not to mention, since IT consumes the majority of an organization's electrical resources, we need to take accountability.

That's why we partnered with PwC to create an ESG Capability Map within LeanIX EAM. This map will allow you to track your ethical debt now, so you won't need to worry about it later.

To learn more about our ESG partnership with PwC and what the LeanIX ESG Capability Map can do for you, download PwC's white paper from their site:

DOWNLOAD: Sustainable Enterprise Architecture From PwC

Let's dive deeper into the concept of ethical debt and why ESG capabilities are so important for your organization.

What Is Ethical Debt?

Ethical debt is the combined consequences of a lack of optimization in your organization's environmental, social, and governance (ESG) capabilities. As pressure on organizations to meet ethical standards intensifies, managing ethical debt is becoming essential.

You will eventually face difficulties if your organization doesn't have a full ESG strategy in place. This strategy will need to include, for example:

- protections against your products being used to exploit consumers

- a solid diversity and inclusion policy

- updated regulatory documentation

Just like technical debt, the consequences of ethical debt aren't just financial. Your debt getting out of control can impact your reputation, relationship with regulators, talent retention, and partnerships.

Another key consideration of the concept of ethical debt, however, is possible exploitation. When you're creating a product, you now need to consider what the consequences could be if it is misused by your customers.

The Consequences of Ethical Debt

Ethical debt isn't just a theoretical concept. Let's look at some of the real consequences that organizations have faced without the support of enterprise architects in preventing their ethical debt from spiraling out of control.

1 PR Nightmares

In April 2023, Bloomberg named and shamed six Wall Street banks that had been cited as underperforming on carbon footprint reduction efforts. Simon Glossner of the University of Virginia Darden School of Business found that such incidents had a verifiable impact on share value.

2 Regulatory Issues

In 2022, Goldman Sachs was fined USD 4 million by the US Securities and Exchange Commission (SEC) for failing to follow its own ESG policies related to three of its Asset Management Fundamental Equity group’s investment portfolios. Regulators are serious about ESG, and paying lip service to the rules isn't enough.

3 Loss Of Talent

A 2021 IBM study found that 71% of jobseekers found sustainable companies more attractive as potential employers. ESG issues are, therefore, a key factor in attracting and retaining top talent.

4 Loss Of Investment And Partnerships

UK bank Barclays recently found that 21% of the UK’s largest retailers had canceled contracts with suppliers on ESG grounds during 2021. Meanwhile, 49% of investors are willing to divest from companies that aren’t taking sufficient action on ESG issues, according to PwC.

5 Loss Of Customer Trust

A range of ESG failures directly contributed to the catastrophic downfall of Credit Suisse, a 167 year-old European banking giant. From the discovery that loans provided for sustainable development projects were used to buy military equipment in Mozambique, to funding Arctic drilling, Credit Suisse's overnight failure is a warning to anyone unconcerned over ESG issues.

The Dangers Of AI

A major environmental, social, and governance (ESG) concern at the moment is how ethical debt is going to impact the use of artificial intelligence (AI) tools like ChatGPT. Just as technical debt in the form of legacy software can prevent you from exploiting modern technology, so can ethical debt cause problems with your use of AI.

There have been various media reports of GPT interfaces offering inappropriate responses it had learned from scraping the internet. Similarly, a lack of ethical debt could also create biases within your own AI tools.

An AI tool based on an IT landscape with ethical debt might encourage you to only sell to white customers, discourage sustainability, or open your system up to inappropriate use by cyber criminals. Before you can take advantage of all the innovations AI offers, you must ensure your ethical debt is manageable.

How You Can Manage Your Ethical Debt

Environmental, social, and governance (ESG) ethical debt is much like technical debt. Every organization has a certain amount and getting it down to zero is likely not worth your investment, but your ethical debt must be reduced to a reasonable level or there will be consequences for your organization.

Why does this fall on enterprise architects, however? Well, a Forrester survey commissioned by Dun and Bradstreet in March 2022 found that the two biggest roadblocks to hitting ESG targets were:

- immature internal data management practices

- lack of trust in ESG data to make decisions

Ensuring your organization is tracking and managing ESG data, and that it can be leveraged for strategic planning is very much in the wheelhouse of enterprise architects. That's why we created a facility for tracking ESG data within our enterprise architecture management platform.

The LeanIX EAM ESG Capability Map

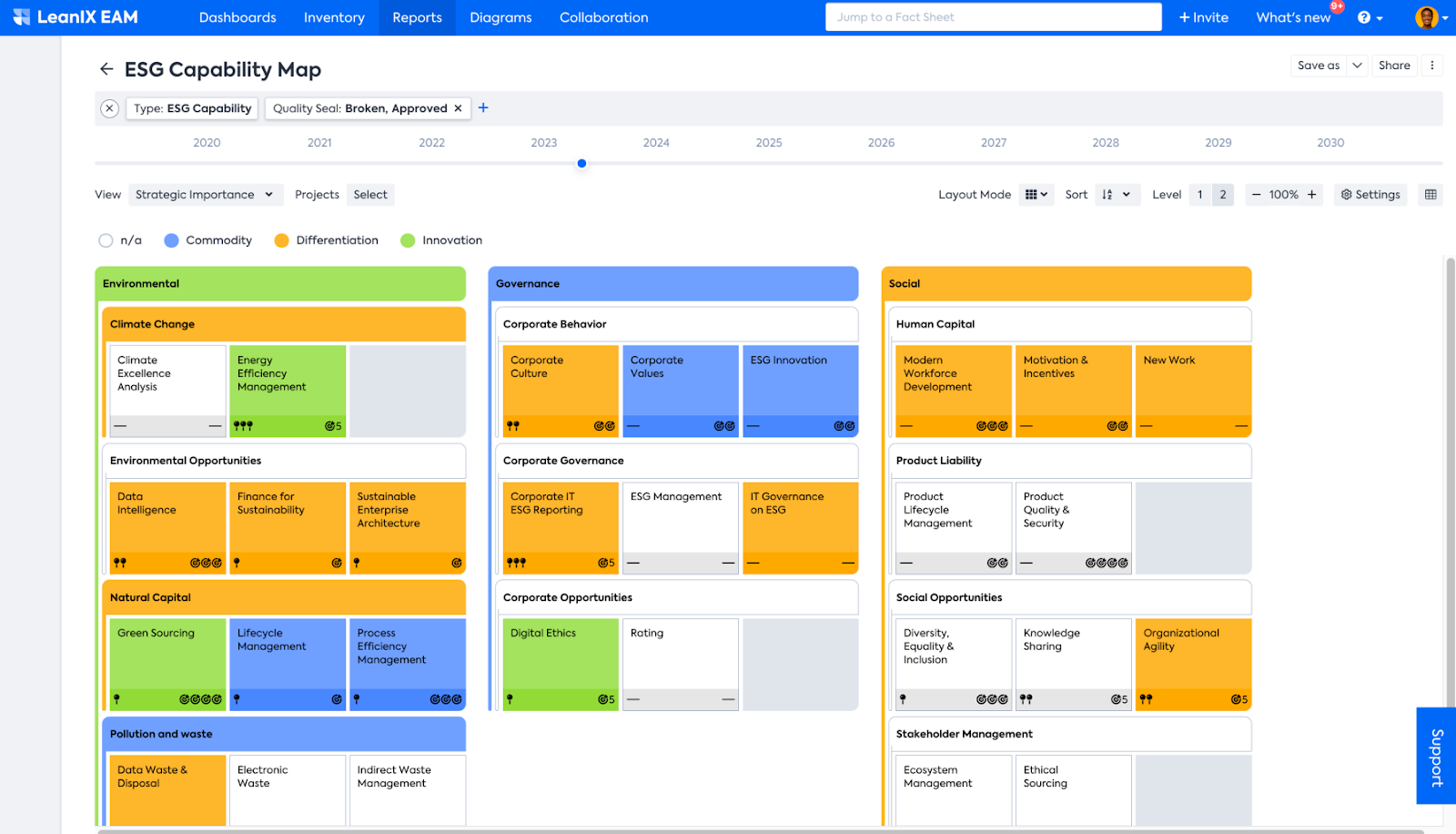

The LeanIX EAM now supports enterprise architects in gathering environmental, social, and governance (ESG) data to help reduce ethical debt using our new ESG Capability Map. This new tool allows you to track your ESG capabilities and map them to your IT landscape.

The ESG Capability Map also enables you to strategize and visualize your ESG initiatives and also create regular reports on your progress. This will empower enterprise architects to lead the way on ESG transformation.

Existing LeanIX EAM admins can add the ESG Capability Map to their toolset now. See our Product Roadmap for more information.

On the other hand, to find out more about the LeanIX EAM, see our product page: