You’ve probably heard the oft-cited statistic that 70% of mergers and acquisitions fail to achieve their projected value. Indeed, research over the years suggested that failure rate might be as high as 90%. In most cases. it was said, the cause was overvaluation or overpayment for the acquired entity.

What you might not know, is that things have changed since 2004 when Bain published Mastering the Merger, which focused on the dismal prospects for most mergers. Today (well, in 2024), Bain reports that executives now consider 70% of their mergers successful. So, what changed?

Taking post-merger integration seriously

One factor, according to Bain, is that “the art of integration has moved from rudimentary to highly sophisticated.” To illustrate their point, they cite critical questions to answer in the integration and planning process. These questions include things like settling on the target sales process for the new, merged organization as well as deciding on key systems of record, such as the ERP solution, to be used by the transformed entity.

These insights from Bain invite some pretty obvious follow-on questions. For instance, how do you know which sales process (or procurement process or lead-to-cash process, etc.) or which enterprise system (ERP, HCM, SCM, etc.) will deliver the most value going forward?

Those driving the merger and acquisition process undoubtedly will have based their decisions on assumptions about post-merger performance, assumptions focused on metrics like market share, profitability, and growth rates. It is unlikely that even the most diligent among them will have dug deep into the relevant processes or underlying IT landscape of the acquired company.

That digging and the comparative analysis that goes with it usually happens only after the deal has been signed. So, what is the best way to answer key questions about systems and processes post-merger?

Building a joint business capability map

Perhaps it goes without saying, but if you are acquiring another company, it pays to get your own house in order first. That is, you will be best served if, prior to considering how you are going to merge two separate IT landscapes, you have already assessed, rationalized, and modernized your own.

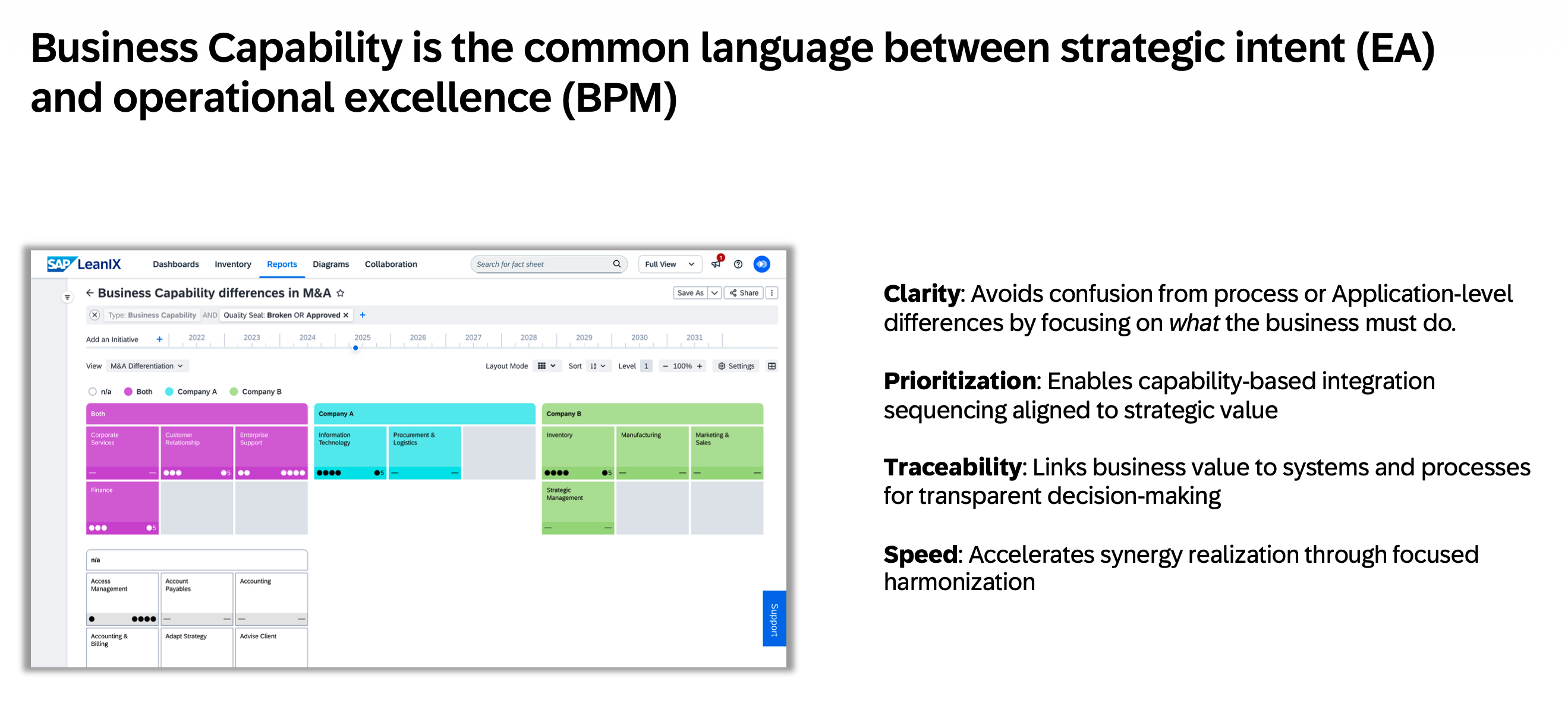

Looking ahead from this ideal state, you will want to develop a framework for making decisions about the future, merged landscape. In the methodology used by the SAP LeanIX professional services team, the first step is creating a business capability map that describes the operational needs of the organization.

While a merger doesn’t necessarily imply that the new entity will demand new or different capabilities than you have today, creating a business capability map creates a shared standard for making decisions about the expanded IT landscape and the process landscape it supports.

Deciding on a pace layer strategy

With this map in hand, you can then think about the pace layer strategy for the combined organization. Pace layers, if you are not familiar with the term, offer a heuristic allowing you to think about the value of technology investments. In its most basic form, pace layering helps you differentiate between technology that is either innovative or differentiating for your business and technology that one could consider a “commodity.”

Any merger or acquisition will result in redundant systems for some business capabilities. Every company needs to pay employees, for example, so it’s quite possible after a merger to end up with two (or more) payroll systems. The same holds true for solutions supporting many core, "commodity" functions, but may also be the case for solutions supporting differentiating functions.

The good news is, with a joint business capability map and shared strategy for assessing your application portfolio, you will have the basic tools needed to begin rationalizing the new IT landscape.

Application portfolio transparency and assessment

From an application portfolio standpoint, the next step is assessing the acquired landscape. If that landscape has already been inventoried and its dependencies and data flows mapped, then your job may be relatively easy. If not, as can often be the case, you may have to do some basic enterprise architecture work before you can get started.

Assessing the IT landscape and conducting a TIME analysis of your applications depends on at least two dimensions. The first is technical fit, which considers whether a particular application plays well with the other applications in your landscape or the platforms you employ.

The second dimension is functional fit. Functional fit considers whether your applications effectively support the relevant business capabilities. One way to determine that is by looking at the role played by each application in your business processes.

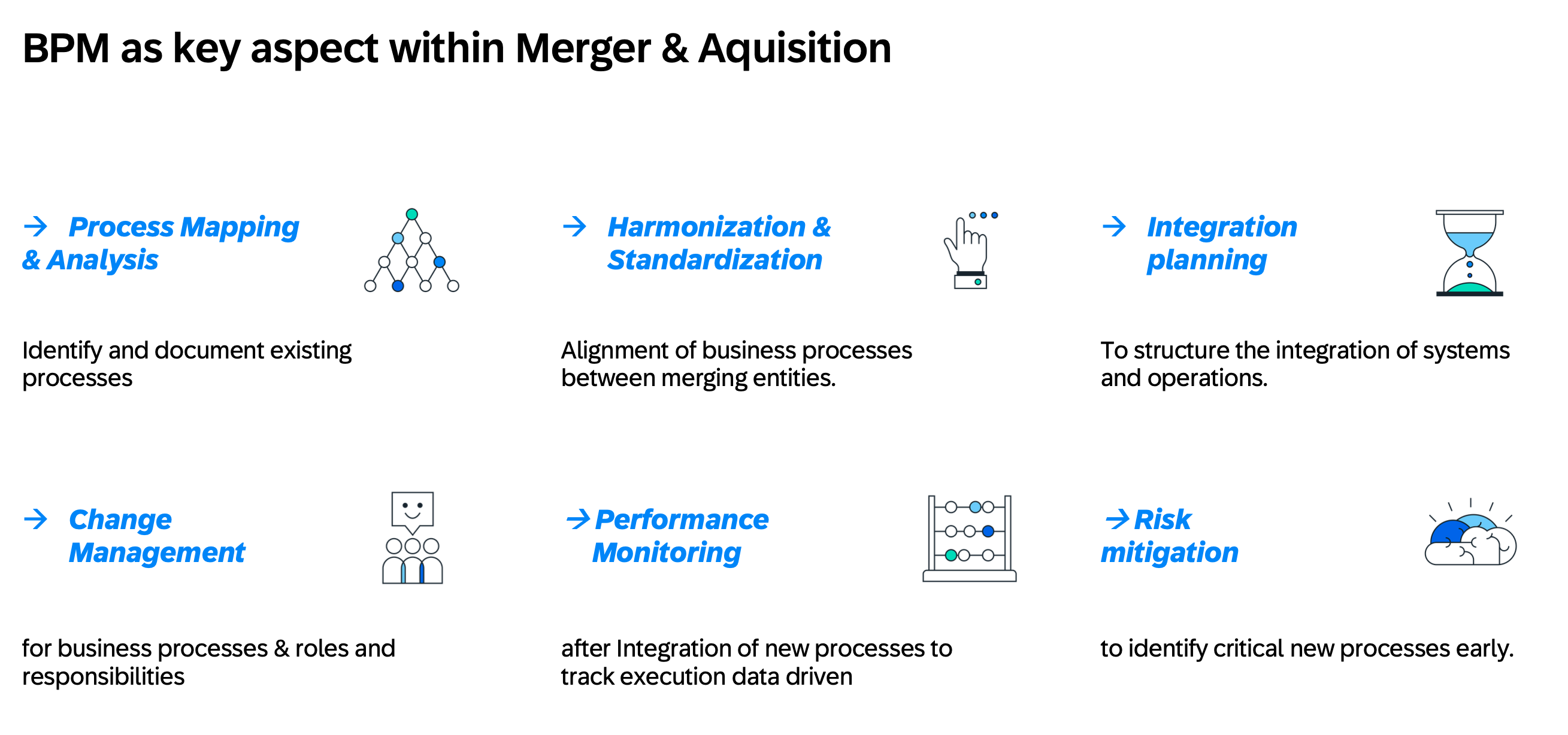

Of course, performing such an assessment presupposes that you actually understand your business processes. And this brings us to another critical component of post-merger integration: business process harmonization.

Understanding and harmonizing the business process landscape

For many years, business process management (BPM) meant, first and foremost, modeling your business processes. While process modeling continues to be a valuable exercise, as with any static model, it can quickly diverge from reality: employees develop workarounds and shortcuts and don’t always follow the ordained paths when it comes to getting work done.

For this reason, process modeling today is often supplemented and even replaced by process mining. The beauty of process mining is it can reveal how your processes truly work, uncovering bottlenecks, common workarounds and areas of both inefficiency and nonconformance with process standards.

Under normal business conditions, the goal of process mining and analysis is process improvement. In the post-merger context, the goal is process harmonization, in other words, aligning processes across the newly formed organization so that everyone is singing from the same sheet of music.

Take the example mentioned above: lead-to-cash. Without mining this process in both organizations and comparing performance with industry benchmarks, you can’t really say which is better. But even if you simply wanted the acquired teams to adopt an existing lead-to-cash process, you would have to have mined and modeled that process in order to enable them and implement it.

And having mined and modeled it, before asking a team to adopt it as a new process, you would also improve and optimize the process.

Laying the groundwork for the future

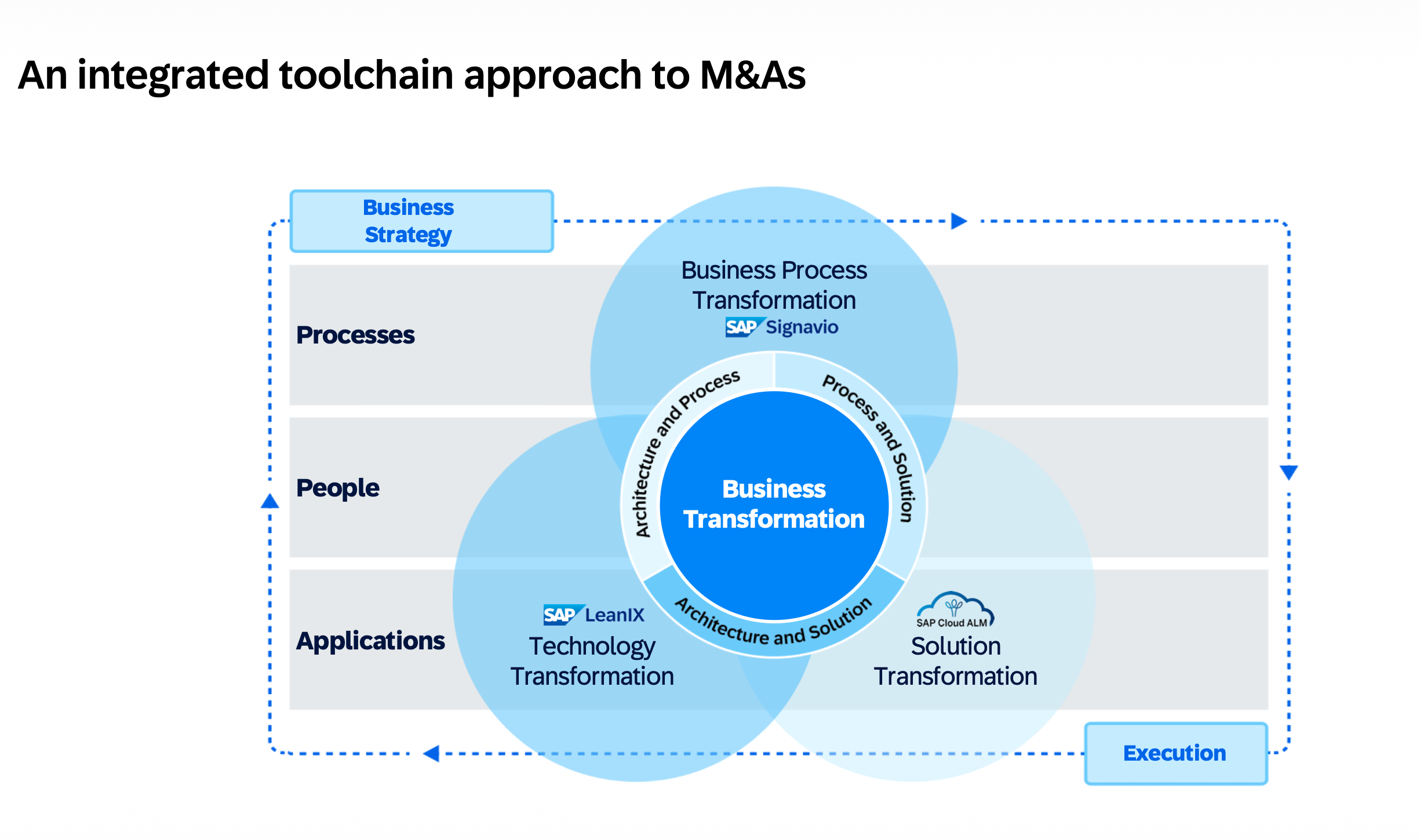

Everything that I have described here, albeit at a high level, lays the foundation for successful post-merger integration. A joint business capability map gives everyone a common language and a shared understanding of the jobs to be done by technology in the merged organization.

Mapping and rationalizing the IT landscapes makes it possible to integrate and streamline them. While mining and analyzing processes allows you to chart a course towards process harmonization.

All this analysis, however, is just the beginning of the post-merger integration journey. What comes next is the implementation of your plans and, even more critically, the continuous monitoring of the new organization’s performance to drive ongoing improvement and, ultimately, ensure that your M&A investment achieves the intended value.

SAP LeanIX Professional Services has helped hundreds of companies do precisely that. And behind our methodology is a set of integrated tools that support M&A from the due diligence phase to post-merger integration and beyond comes after.

If you would like to learn more....